Brought to you by the Latino Business Action Network

The Impact of Hispanic Business: A Deep Dive into Hispanic Entrepreneurship

Highlighting Excellence, Exposing Barriers, and Defining a Plan of Action

The data found on this page comes from the Stanford Latino Entrepreneurship Initiative (SLEI), which is a collaboration between the Latino Business Action Network (LBAN) and Stanford's Graduate School of Business (GSB). Links to this data can be found at the bottom of this page.

Hispanic Excellence in Entrepreneurship

Open for Business

The Hispanic population is overrepresented among startups. As of 2018, Hispanics made up 17 percent of the U.S. population, and 24 percent of all new entrepreneurs5. This means that Hispanic entrepreneurs are some of the first to take on a new venture when an opportunity presents itself. Despite the impressive number of businesses that are being started by Hispanics, the Hispanic population is still underrepresented among all firms in the U.S. But there is good news on this front too: Hispanic businesses are growing at an even faster rate than the U.S. Hispanic adult population3. If this trend continues, this means that the business community can one day expect to see Hispanic representation among entrepreneurs equal to the Hispanic population in the U.S. In addition, immigrant-owned firms are overrepresented among larger firms, which implies that Hispanic immigrant entrepreneurs are having a "positive effect of the U.S. economy through job and revenue creation"2. These patterns suggest that Hispanic entrepreneurs of all backgrounds are tenacious, productive, and here to stay. This should come as good news, and here's why.

The Rising Tide That Lifts All Boats

The Hispanic community stands to benefit from an increase in entrepreneurial success. However, so does the rest of the country. The statistics tell us that Hispanic firms serve a broader constituency than just Hispanics and that an increase in their wealth would impact the entire country. This is because "less than one-quarter of firms are in majority Latino neighborhoods," and "a majority of firms report that over half of their clients or employees are non-Latinos"2. This combats a common misconception that Hispanic firms only exist within the boundaries of Hispanic enclaves. Instead, the data proves that Hispanic firms are everywhere, and they serve everyone: a clear indication that supporting Hispanic entrepreneurship is a rising tide that lifts all boats.

Bringing it Home

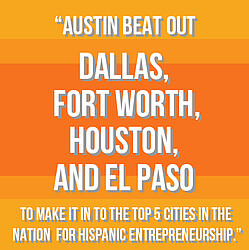

Here in the 512, we've got even more bragging to do. That's because the great state of Texas contains 18% of Hispanic-owned firms in the U.S. and the city of Austin contains 1.6% of Hispanic-owned firms in the U.S.2. This puts Texas in second place just behind California; and it puts Austin in fifth place behind New York, San Antonio, Los Angeles, and Miami. That means that Austin beat out Dallas, Fort Worth, Houston, and El Paso to make it into the top 5 cities in the nation for Hispanic entrepreneurship. This a positive sign, but it means that our work is just getting started. Austin needs to continue to support our Hispanic-owned businesses by helping them scale and network. Moreover, Austin needs to continue to look toward the future by recruiting a new generation of Hispanic entrepreneurs.

Breaking Stereotypes

A new generation of Hispanic entrepreneurs is already on the rise. Successful Hispanic immigrant entrepreneurs are "more likely to be millennials who came as children to the United States." The data shows that 86 percent of large ($1M+) immigrant-owned firms are owned by millennials who immigrated as children3. Some social scientists attribute this to "immigrant optimism", which is a phenomenon that describes how young immigrants have a unique motivation to perform and succeed because "the immigrant often takes on the challenge where others don't because he or she believes that in doing, so life will get better"7. This fact proves that often, stereotypes are wrong. Instead of taking jobs, young immigrants are coming to the U.S. and creating jobs that didn't exist before.

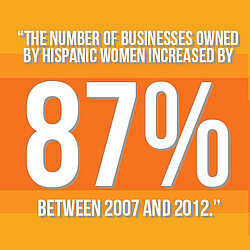

Hispanic entrepreneurs are breaking stereotypes on other fronts, too. The number of businesses owned by Hispanic women increased by 87 percent between 2007 and 2012 - and businesses owned by women represent nearly half of all Hispanic owned firms today3.

Moreover, "less than one-quarter of Latino firms are in construction or manufacturing, and even fewer are in leisure or hospitality," which combats a common stereotype that Hispanic entrepreneurs own mostly restaurants and construction firms2. There is also research that indicates that large firms and small firms are both located in communities with similar proportions of Hispanics, which suggests that Hispanic firms "did not have to move to communities with fewer Latinos in order to grow"2. In other words, Hispanic firms are scaling regardless of the ethnic makeup of the community. Despite these positive indicators, however, there is still plenty of work to be done to advance opportunity and achievement for Hispanic entrepreneurs.

The Biggest Challenge for Hispanic Entrepreneurs: Scaling Up

The Facts of the Case

Although Hispanic entrepreneurs are overrepresented among startups, they are severely underrepresented among large employer firms. Businesses owned by Hispanics “make up only 6 percent of all business with employees and less than 5 percent of business with more than $1 million in revenue”5. This evidence makes it clear that the biggest challenge for Hispanic entrepreneurs is not starting a business; it’s growing one.

To interrogate this problem further, it’s essential to understand why Hispanic-owned businesses are having trouble growing. After slicing up the data, it’s clear that the biggest hurdle for Hispanic entrepreneurs is crossing the “employment threshold”. Among the universe of Hispanic business-owners, only 16% convert their businesses from a self-employed business to an employer business. Non-Hispanics, however, have a conversion rate of 36%5. So why are Hispanic entrepreneurs having trouble crossing the employment threshold?

Diagnosing the Problem

Do Hispanic business owners have different motivations that non-Hispanic business owners? If so, this might explain why Hispanic entrepreneurs are not scaling up and why they’re not hiring employees. Although this may seem like a tempting explanation for these differences, research shows that Hispanics and non-Hispanics alike list the same top three reasons for owning a business: “Greater Income,” “Wanted to be my own boss,” and “Balance work and family”5. Also, Hispanics and non-Hispanics list these motivations at almost precisely the same rates – there is virtually no difference in the motives of these two groups5.

Do Hispanic business owners choose to start their businesses in industries without growth opportunities? Indeed, Hispanic business owners don’t choose the same industries as non-Hispanic business owners. The top two industries for non-Hispanics are “professional, scientific and technical services” and “retail trade.” Meanwhile, the top two industries for Hispanics are “construction” and “accommodation and food services.” This difference, however, does not explain the scaleup gap. In virtually every industry, non-Hispanic owned businesses are larger than Hispanic-owned businesses5. This means that even if Hispanic entrepreneurs switch their industry choices to match the preferences of non-Hispanics perfectly, they would still be smaller. Differences in industry choice do not explain the scaleup gap.

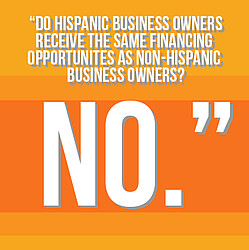

Do Hispanic business owners receive the same financing opportunities as non-Hispanic business owners? No. In fact, “among those that attempted to receive growth funding from a financial institution, 6.2 percent of Latino employer firms did not receive the requested funds, compared to 3.1 percent for non-minority-owned firms”3. Other funding discrepancies exist, too. Hispanic firms have the “lowest number of loans from a financial institution among all demographic groups,” and Hispanic firms rely heavily on hard money, which usually comes with much higher interest rates3. Also, Hispanic firms have “the lowest numbers of business loans from federal, state, and local government, or government-guaranteed business loans from financial institutions”3. With these statistics in mind, it appears that the leading cause of the scaleup problem is a lack of access to funding. So, what can we do about it?

Do Hispanic business owners receive the same financing opportunities as non-Hispanic business owners? No. In fact, “among those that attempted to receive growth funding from a financial institution, 6.2 percent of Latino employer firms did not receive the requested funds, compared to 3.1 percent for non-minority-owned firms”3. Other funding discrepancies exist, too. Hispanic firms have the “lowest number of loans from a financial institution among all demographic groups”, and Hispanic firms rely heavily on hard money, which usually comes with much higher interest rates3. In addition, Hispanic firms have “the lowest numbers of business loans from federal, state, and local government, or government-guaranteed business loans from financial institutions”3. With these statistics in mind, it appears that the main cause of the scaleup problem is a lack of access to funding. So, what can we do about it?

Looking for Answers

To find answers, we can ask Hispanic entrepreneurs what they need to secure funding. Many Hispanic entrepreneurs report a lack of preparedness that may be impeding access to external financing. To be more specific, Hispanic entrepreneurs often lack the documentation required to secure external funding. Among unscaled firms (<$1M), only 23% have tax returns, 16% have a current balance sheet, 13% have a financial plan, and 20% have a business plan3. Besides, many Hispanic entrepreneurs exhibit an uneasiness when it comes to securing external funding because of a previous loan denial, a lack of connections, or a feeling of being unqualified3. This psychological barrier is even worse among Hispanic women, who feel less qualified than men- also when holding firm size constant3. Acknowledging these barriers may be difficult, but it helps to create a roadmap for positive change.

A Plan of Action: How to Help Hispanic Entrepreneurs

Funding Access

Since funding access is the biggest problem facing Hispanic entrepreneurs, we need to do everything we can to help Hispanic-owned businesses access growth funding from financial institutions, government loans, and other external funding resources. To achieve funding access, community partners can help entrepreneurs learn the ins and outs of external funding, including preparing documentation, finding sources of financing, and overcoming psychological barriers.

Mentorship

Several studies have confirmed that “mentorship [is] a key factor for entrepreneurial success,” and yet only 34% of Latino business owners have a mentor1. Anecdotal evidence also suggests that large firms have been successful because they use “people-centered approaches – such as relying upon mentors – as their first step in seeking guidance or information”3. One of the best ways for our community partners to help Hispanic entrepreneurs is to mentor an entrepreneur. Mentorship is also a great way to solve funding problems on a smaller scale because mentors can help their mentees prepare documentation and learn about funding sources.

Education

In general, supporting education is a good way to support positive outcomes. But this is especially true among entrepreneurs. In the U.S., "52 percent of all employer business… are owned by people with a bachelor’s degree or higher”5. And among Hispanics, higher education is a great way to boost growth. This is because “Latino business owners of scaled firms have higher educational attainment than owners of unscaled businesses”5. Therefore, our community partners can boost entrepreneurial achievement by supporting education programs, scholarship programs, and other educational opportunities for Hispanics.

Making Connections

Making connections is one of the things that the GAHCC does best. And, for good reason. Highly networked firms are much more likely to be scaled. In fact, “76% of networked firms are scaled firms”4. This means that membership in business organizations like the GAHCC is highly correlated with economic achievement. This is because organizations like ours help “by virtue of referrals, access to information, or other business opportunities”4. Continued participation in the GAHCC allows firms and community partners alike to be well networked and, as a result, more successful.

Supporting Immigrant Entrepreneurs

As of 2016, “40-50 percent of larger [Hispanic] firms – high-revenue and high-employee firms – are immigrant-owned”2. This means that, among the Hispanic population, immigrant-owned firms are much more likely to scale-up and to cross the employment threshold. Immigrants are job-creators, revenue-creators, and positive forces in the U.S. economy. Our community partners can strengthen Hispanic entrepreneurship by ensuring that immigrants continue to achieve and to excel.

Supporting Hispanic Women

Firms owned by Hispanic women “tend to be smaller than male-owned firms”3. This may be because “Latinas feel that they are not qualified to access funding from financial institutions at higher percentages as compared to men (40 percent vs. 21 percent), even when compared to men with similarly sized firms”3. Therefore, a funding ceiling exists that may be external or self-imposed, which is preventing Latinas from scaling. To support Hispanic women, community partners should encourage women to pursue external funding. We should also continue to ask Latina entrepreneurs how we can best support them.

Footnotes

1 2015 State of Latino Entrepreneurship

2 2016 State of Latino Entrepreneurship

3 2017 State of Latino Entrepreneurship

4 2018 State of Latino Entrepreneurship

5 2018 Latino Entrepreneurship Gap Report

6 Latino-Owned Businesses: Shining a Light on National Trends

7 The Optimistic Immigrant: Among Latinos, the Recently Arrived Have the Most Hope for the Future